Securing Your Earnings: The Strength of Disability Income Protection Insurance

Shielding Your Income: The Significance of Disability Income Protection Insurance

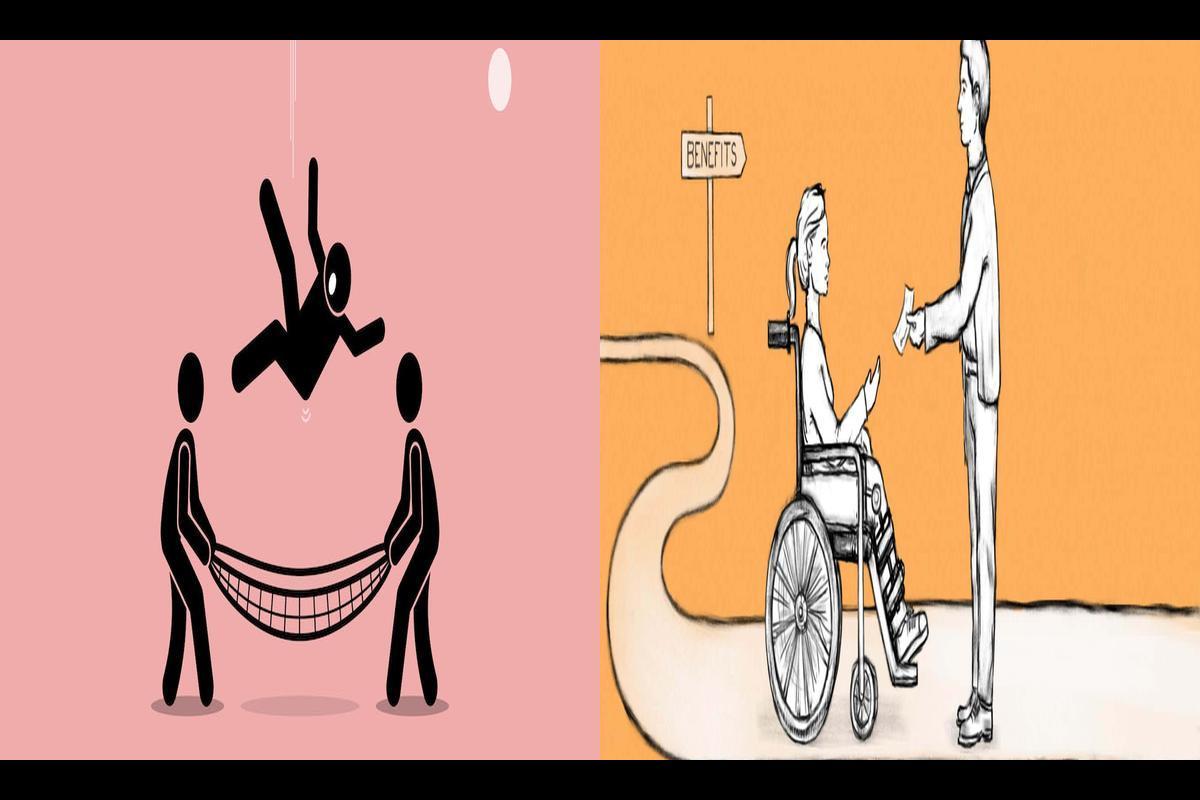

News: Amidst the intricacies of financial planning, the significance of safeguarding oneself from unforeseen events often goes unnoticed by many. Preserving the capacity to generate income is vital for financial well-being, underscoring the potency of Disability Income Protection Insurance as a robust defense against life’s unpredictabilities.

Understanding Disability Income Protection Insurance

To grasp the full impact of Disability Income Protection Insurance, let’s delve into its core concept. This insurance is crafted to step in and substitute a portion of your income in the event that you are unable to work due to a qualifying disability.

Disability Income Protection Insurance differs from conventional medical expense-based policies by considering income disruptions during periods of disability. It acts as a crucial safety net, guaranteeing that individuals can cover crucial living costs like mortgage payments and daily essentials, alleviating the burden of financial pressure.

Qualifying Disabilities

Disability insurance encompasses various short and long-term incapacities, spanning injuries, illnesses, or medical issues that temporarily hinder an individual’s capacity to work. Short-term protection typically covers accident-induced injuries, while prolonged coverage extends to chronic illnesses impacting an employee’s work abilities over an extended duration. Long-term disabilities commonly entail more severe conditions that significantly limit or entirely prevent a person from working for an extended or potentially permanent period.

Income Replacement Percentage

Disability Income Protection Insurance generally substitutes a portion of your pre-disability earnings, typically ranging from 50% to 70%, depending on your policy. This coverage aims to offer adequate financial support, ensuring you can manage essential expenses while prioritizing your recovery.

The Power of Financial Security in Unforeseen Circumstances

Disability Income Protection Insurance holds significant strength in preserving financial stability amidst unforeseen challenges. When disability hits, the resulting financial impact can be profound—bills accumulate, and the absence of a regular income source can trigger stress and anxiety. This insurance serves as a safety net, providing a consistent income flow to manage daily expenses, safeguarding financial stability from being compromised.

Disability Income Protection Insurance extends beyond fulfilling essential needs; it plays a pivotal role in upholding your lifestyle. By covering expenses like mortgage or rent, groceries, and utilities, the substituted income enables individuals and their families to sustain their accustomed standard of living despite encountering a disability. This preservation becomes particularly crucial, alleviating the weight of financial pressure during an already demanding period.

Key Features and Benefits

Disability Income Protection Insurance offers a remarkable degree of adaptability, catering to individuals’ diverse needs. Policies can be customized to address specific disability periods, empowering individuals to select coverage that suits their particular situations. Whether opting for short-term or long-term protection, this flexibility ensures that the insurance aligns precisely with the distinctive requirements of each policyholder.

It’s crucial to grasp the difference between own-occupation and any-occupation policies when assessing Disability Income Protection Insurance. Own-occupation policies deem you disabled if you can’t perform the duties of your specific occupation, granting broader coverage, especially beneficial for those with specialized skills. Conversely, any-occupation policies define disability based on your ability to perform any job you’re reasonably qualified for based on education, training, or experience. While own-occupation policies often offer more extensive coverage, they might entail a higher premium compared to any-occupation policies.

Disability doesn’t just impact your present income; it can also endanger your future financial stability. Disability Income Protection Insurance helps safeguard retirement savings. By providing a consistent income stream, it ensures ongoing contributions to retirement accounts even during a disability period, lessening the long-term financial repercussions. This helps maintain financial security beyond the immediate impact of disability.

Navigating the Policy Landscape

Similar to any insurance, comprehending the specifics of Disability Income Protection policies is paramount. Coverage limits denote the maximum income replacement, which varies across policies. Moreover, there are waiting periods before benefits activate. Grasping these limits and waiting periods is crucial to ensure the policy meets your financial requirements and aligns with your expectations. This understanding helps in making an informed decision about the coverage that suits your needs.

Thoroughly examining the exclusions and limitations within Disability Income Protection Insurance policies is essential. Some conditions might be excluded, and pre-existing conditions could affect the coverage. Understanding these aspects provides clarity about what your policy covers and doesn’t cover. This knowledge is crucial for making informed decisions and managing expectations regarding the extent of your insurance protection.

The Role of Technology in Accessibility

In today’s digital era, technology has substantially improved the accessibility of Disability Income Protection Insurance. Online platforms empower individuals to research, compare, and purchase policies conveniently. This accessibility is especially advantageous for busy individuals, offering them the flexibility to explore Disability Income Protection options from the comfort of their homes, fitting into their demanding schedules seamlessly.

Traditional insurance procedures often entailed extensive paperwork and in-person meetings. However, digital platforms have revolutionized the application process, enabling individuals to submit applications and necessary documents online. This not only saves time but also significantly boosts the efficiency of acquiring Disability Income Protection Insurance. The streamlined digital approach simplifies the process, making it more accessible and user-friendly for potential policyholders.

Absolutely, technology revolutionizes claims processing and communication in insurance. Digital platforms enable swift and efficient claims submissions, allowing policyholders to submit claims online. Advanced algorithms and artificial intelligence accelerate the verification process, ensuring timely processing of eligible claims. This rapid response provides crucial financial support precisely when it’s most needed, easing the burden during challenging times of disability.

Selecting the Right Policy: Tips for Individuals

When selecting a Disability Income Protection Insurance policy, evaluating your income replacement needs is crucial. Take stock of your monthly expenses, encompassing items like mortgage or rent, utilities, groceries, and other essential costs. This assessment serves as a compass, guiding you toward a policy that offers sufficient coverage to sustain your financial stability in case of disability. Understanding your needs ensures that the policy aligns closely with your requirements, safeguarding your financial well-being during challenging times.

Absolutely, scrutinizing and comprehending the policy’s terms and conditions is vital. Focus on coverage limits, waiting periods, and potential exclusions. Address any uncertainties by seeking clarification from the insurance provider to ensure a thorough understanding of the policy. This diligence helps in making informed decisions and ensures that the coverage aligns accurately with your needs, avoiding surprises and ambiguities during the claims process.

When deliberating between own-occupation and any-occupation policies, it’s crucial to assess your occupation and career aspirations. If you hold a specialized profession, an own-occupation policy might provide broader coverage. However, consider this against the potential higher premium that often accompanies this type of policy. Weighing the benefits against the cost can help determine which policy aligns best with your occupation and financial considerations.

Indeed, Disability Income Protection Insurance policies often feature additional riders or add-ons that can amplify coverage. Exploring options like cost-of-living adjustments, future purchase choices, or residual disability benefits can offer supplementary layers of protection tailored to your specific requirements. Assessing these riders allows you to customize your policy, potentially bolstering your coverage to better suit your needs and circumstances.

Absolutely, Disability Income Protection Insurance stands as a robust ally in strengthening your financial security against life’s unexpected hurdles. Its strength lies in not just replacing lost income but also in safeguarding your financial stability and maintaining your lifestyle during periods of disability. With advancing technology, the accessibility and efficiency of Disability Income Protection Insurance have significantly improved, making it more attainable and manageable for individuals looking to protect their income and secure their financial well-being.

Absolutely, selecting the appropriate Disability Income Protection Insurance demands thoughtful consideration of your unique needs, a comprehensive grasp of policy terms, and a thorough examination of available choices. Embracing this potent form of insurance not only shields your current income but also secures your future financial stability. It’s a proactive step toward safeguarding your financial well-being, offering reassurance and support during unexpected life events.

FAQ’s

Q: Does Disability Income Protection Insurance encompass every form of disability?

A: Disability Income Protection Insurance offers coverage for various short and long-term disabilities, encompassing injuries, illnesses, and medical conditions impacting an individual’s work capacity.

Q: What portion of my income does Disability Income Protection Insurance replace?

A: Disability Income Protection Insurance generally substitutes a portion of your pre-disability income, often falling within the range of 50% to 70%.

Q: Is it possible to buy Disability Income Protection Insurance online?

Certainly! In today’s digital landscape, technology has streamlined the process, allowing for research, comparison, and online purchase of Disability Income Protection Insurance, offering enhanced accessibility and convenience for individuals.

Note: All informations like net worths, obituary, web series release date, health & injury, relationship news & gaming or tech updates are collected using data drawn from public sources ( like social media platform , independent news agency ). When provided, we also incorporate private tips and feedback received from the celebrities ( if available ) or their representatives. While we work diligently to ensure that our article information and net worth numbers are as accurate as possible, unless otherwise indicated they are only estimates. We welcome all corrections and feedback using the button below.

Advertisement