Home Loan Processing Fees, And Hidden Charges All Banks

Understanding the Various Fees Associated with a Home Loan

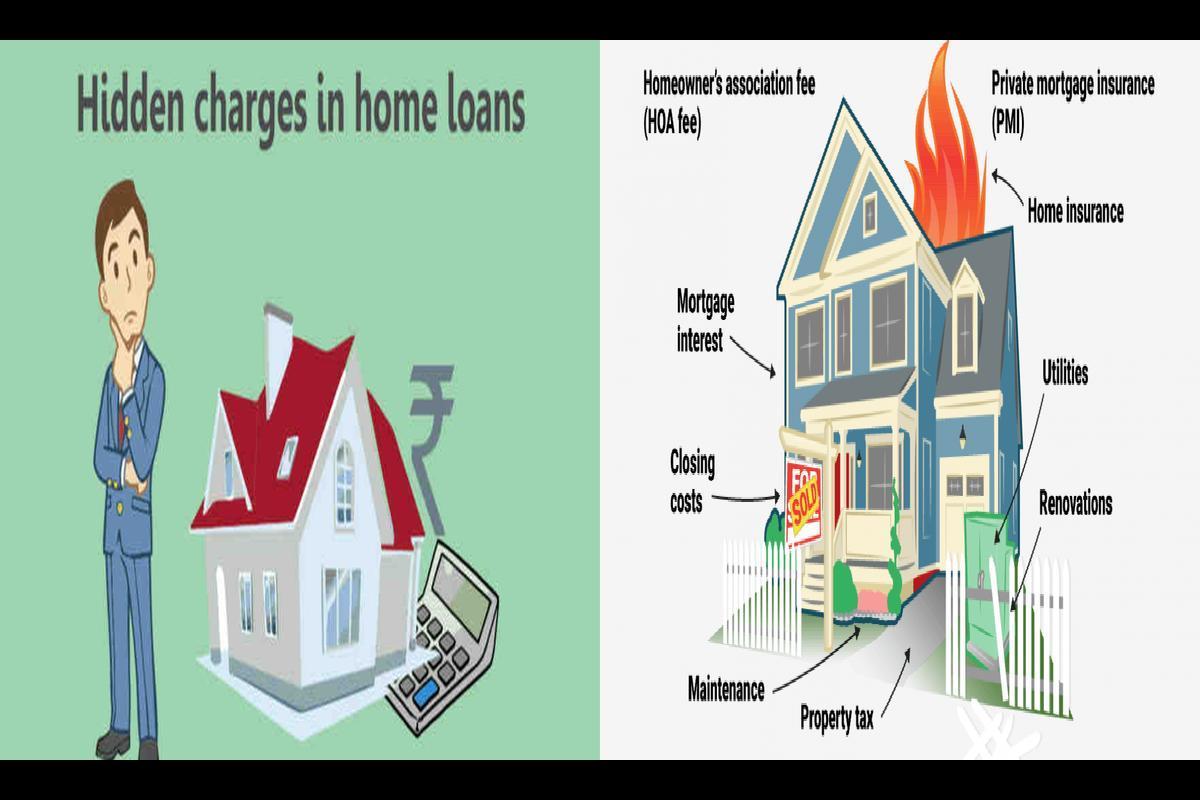

News: In realizing the dream of home ownership, a significant number of individuals turn to home loans for financial support. Yet, it becomes crucial to understand the various fees linked to the process of applying for a home loan. This article delves into the typical charges associated with securing a home loan.

Processing Fees

A fee that will be part of your home loan application is the processing fee. This non-refundable charge is a one-time payment required during the processing of your loan application. Typically, the processing fee is a percentage of the loan amount, falling within the range of 0.5% to 1%. It is crucial to incorporate this expense into your overall assessment of the total cost associated with your home loan.

Legal Charges and Valuation Fees

Additional fees to take into account are the legal charges and valuation fees. These charges encompass the expenses associated with legal inspections of property documents, ensuring the property is devoid of any legal complications. The magnitude of legal charges can fluctuate based on the intricacy of the legal verification process. Conversely, valuation fees are imposed by the lender to ascertain the market value of the property. This step ensures that the loan amount corresponds to the property’s actual worth.

Stamp Duty and Registration Charges

Fees such as stamp duty and registration charges exhibit variability across different states in India. These charges pertain to the official documentation of the property in your name. Stamp duty is contingent on the state and its regulations, while registration expenses are computed based on the property’s valuation. Being mindful of these charges is crucial, as they can exert a substantial influence on the overall cost of your home loan.

Loan-to-Value Ratio

An influential factor impacting the loan amount is the Loan-to-Value (LTV) ratio. This ratio denotes the percentage of the property’s value that the lender is prepared to finance. In India, lenders commonly provide LTV ratios ranging from 75% to 90%, with 80% serving as the standard benchmark. Comprehending the LTV ratio is essential, as it delineates the amount for which you qualify in terms of borrowing.

Income and Repayment Capacity

Your eligibility for a home loan is assessed by lenders through an evaluation of your income and repayment capacity. A greater income typically correlates with a higher loan amount. Lenders also scrutinize your capability to make monthly repayments, emphasizing the importance of comfortably managing the proposed home loan. Establishing a stable income and demonstrating a robust repayment capacity becomes imperative to enhance the likelihood of securing a larger loan amount.

Credit History

In conclusion, the significance of a good credit history in the home loan application process cannot be overstated. A favorable credit score not only reflects financial discipline but also enhances the prospects of securing a more substantial loan amount. Lenders typically favor applicants with a credit score surpassing a specified threshold, commonly around 750 or higher. Maintaining a positive credit history is paramount for improving the likelihood of obtaining the desired loan amount.

To sum up, a comprehensive understanding of the various fees associated with a home loan is essential for a holistic perspective on the overall cost. These include processing fees, legal charges, valuation fees, stamp duty, registration charges, Loan-to-Value ratio, income, repayment capacity, and credit history. By staying informed about these fees and factors, you can make informed decisions and ensure a seamless and stress-free home loan application process.

FAQs

Q: What is the processing fee for a home loan?

A: The processing fee for a home loan is a one-time, non-refundable charge that is usually a percentage of the loan amount, ranging from 0.5% to 1%.

Q: How do stamp duty and registration charges vary?

A: Stamp duty is a state-specific charge, while registration expenses are based on the value of the property.

Q: How does credit history affect the home loan application process?

A: A good credit score indicates financial discipline and increases the likelihood of securing a higher loan amount. Lenders usually prefer candidates with a credit score above a specified threshold, typically around 750 or higher.

Note: All informations like net worths, obituary, web series release date, health & injury, relationship news & gaming or tech updates are collected using data drawn from public sources ( like social media platform , independent news agency ). When provided, we also incorporate private tips and feedback received from the celebrities ( if available ) or their representatives. While we work diligently to ensure that our article information and net worth numbers are as accurate as possible, unless otherwise indicated they are only estimates. We welcome all corrections and feedback using the button below.

Advertisement